Navigating Medicare Part B Supplemental Insurance Costs

Are you approaching Medicare eligibility and feeling a little overwhelmed by the alphabet soup of plans and options? You're not alone. One common area of confusion revolves around Medicare Part B supplemental insurance, often called Medigap. Figuring out the typical Part B supplemental insurance expenses is a crucial step in planning for your healthcare future.

Medicare Part B covers essential medical services like doctor visits and outpatient care, but it doesn't cover everything. There are still out-of-pocket costs like copayments, coinsurance, and deductibles. That's where Medigap comes in. These supplemental policies help fill the gaps in Original Medicare coverage, offering financial peace of mind. Understanding the expense associated with these plans is paramount.

Navigating the world of Medicare supplemental insurance can feel like a daunting task. This article aims to demystify the typical Part B supplemental plan price and provide you with the information you need to make informed choices. We'll delve into the factors influencing the cost, the different types of Medigap plans available, and how to find the best fit for your budget and healthcare needs.

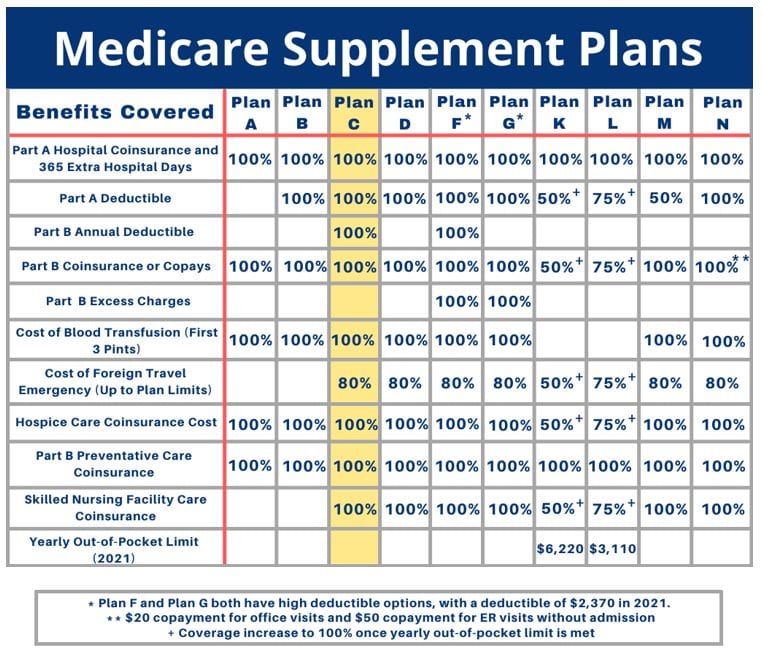

One of the first things to consider when researching Medicare Part B supplemental coverage is the variety of plans offered. Each plan, labeled with a letter (A, B, C, D, F, G, K, L, M, and N), offers a different set of benefits. Naturally, the more comprehensive the coverage, the higher the typical Part B supplemental premium. Factors like your age, location, and the insurance company you choose will also play a role in determining the final cost.

It's important to remember that the cheapest Medigap plan isn't necessarily the best option. While a lower monthly premium might seem appealing, it could mean higher out-of-pocket expenses down the line. The key is to strike a balance between affordability and the level of coverage you need. Evaluating your individual health situation and predicted medical expenses can help you determine the right amount of supplemental coverage.

The history of Medigap policies is intertwined with the evolution of Medicare itself. As gaps in Original Medicare coverage became apparent, the need for supplemental insurance arose. Medigap plans were standardized in 1992, making it easier for beneficiaries to compare options. The standardization helped to clarify what each plan covers and simplified the process of choosing a plan. Over time, new plans have been introduced to adapt to changes in healthcare needs and costs.

Understanding the Part B supplement price landscape is crucial for anyone navigating the Medicare system. It empowers you to make informed decisions, protecting your financial well-being and ensuring access to the healthcare services you need. By carefully weighing the typical monthly premium against the potential out-of-pocket expenses, you can choose a Medigap plan that aligns with your individual circumstances.

Advantages and Disadvantages of Considering Average Costs

| Advantages | Disadvantages |

|---|---|

| Provides a baseline for budgeting | Doesn't reflect individual circumstances |

| Helps compare different plan options | Can be misleading without considering specific needs |

Frequently Asked Questions:

1. What is the average cost of Part B supplemental insurance? - This varies based on plan, location, and age, but you can use online tools and resources to get estimates.

2. How do I choose the right Medigap plan? - Consider your health needs, budget, and the coverage offered by different plans.

3. When can I enroll in Medigap? - The best time is during your Medigap Open Enrollment Period.

4. Can I switch Medigap plans later? - You can, but it might be more difficult and could involve underwriting.

5. What is the difference between Medigap and Medicare Advantage? - Medigap supplements Original Medicare, while Medicare Advantage is an alternative to Original Medicare.

6. Are there resources available to help me understand Medigap costs? - Yes, the Medicare website and State Health Insurance Assistance Programs (SHIPs) offer valuable information.

7. What are the most popular Medigap plans? - Plans G and N are currently popular choices.

8. Can I have both Medigap and Medicaid? - Yes, in certain situations, you can have both.

In conclusion, understanding the average cost of Part B supplemental insurance is an essential part of preparing for your healthcare future. By carefully considering your individual needs, researching the various Medigap plans available, and comparing prices, you can make informed decisions that empower you to access the care you need while protecting your financial well-being. Don't hesitate to seek guidance from resources like the Medicare website or your State Health Insurance Assistance Program (SHIP) for personalized support. Taking the time to thoroughly research and understand your options is a valuable investment in your health and peace of mind. This knowledge will allow you to confidently navigate the complexities of Medicare and choose the right supplemental coverage to meet your unique needs. Remember, informed choices lead to greater financial security and better health outcomes in the long run.

Ganyu rerun in genshin impact a cryo queen comeback

Unraveling the lil tony question

Unleash the power exploring the gmc 2500 sierras towing prowess