Decoding the Bank Account Closure Letter

Severing ties with your bank? It's a digital age, yet the often-overlooked bank account closure letter remains a key component of this process. Whether you're switching banks, consolidating finances, or simply closing a dormant account, understanding the nuances of this seemingly simple document can save you time, hassle, and potential financial headaches.

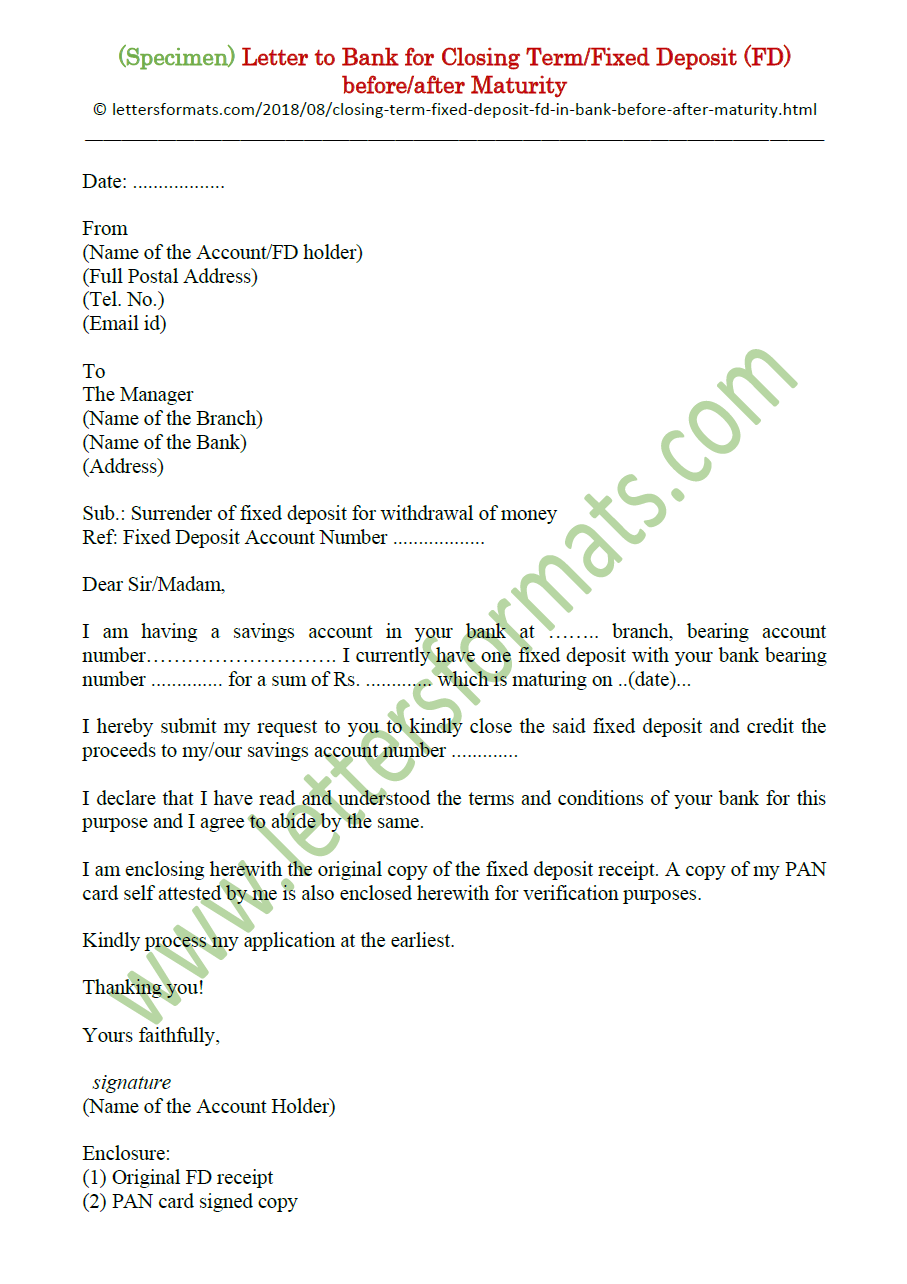

Terminating a banking relationship involves more than just clicking a button. The formal request to close a current account, often delivered through a bank account closure letter, acts as a crucial record for both you and the financial institution. It initiates the formal closure process and ensures a clear understanding of the terms and conditions involved.

While the specific requirements may vary between banks, a well-crafted current account termination letter generally includes essential information such as your account number, the date of closure request, and your forwarding address for any remaining funds. This document serves as a safeguard against future disputes and ensures a smooth transition. Neglecting this seemingly simple step can lead to complications down the road, including unresolved fees or difficulties accessing funds.

The history of the bank account closure letter is tied to the evolution of banking itself. Before the digital era, written communication was the primary mode of interaction with financial institutions. This formal approach has persisted, even in today's digital banking landscape, offering a level of clarity and legal protection that electronic communication sometimes lacks.

The importance of the account closure letter lies in its ability to provide a clear and documented trail of your request. It serves as proof of your intention to close the account and helps prevent any misunderstandings regarding outstanding balances, automatic payments, or future transactions. This is crucial in protecting your financial interests.

For example, imagine setting up recurring payments from a current account you intended to close. Without a formal closure request, these payments might bounce, leading to penalties and potential damage to your credit score. A closure letter ensures the bank is aware of your intentions and can guide you through the necessary steps to avoid such issues.

One benefit of formally closing a bank account with a letter is the clear communication it provides, minimizing the risk of errors and misunderstandings. Another benefit is the added layer of security it offers by creating a documented record of your request. Finally, it ensures a smooth and efficient closure process, reducing the chance of delays or complications.

To close a current account, first, gather all necessary information, including your account number, contact details, and any outstanding checks. Second, draft a formal letter stating your intention to close the account, providing all relevant details. Finally, deliver the letter to your bank and confirm receipt.

Advantages and Disadvantages of Using a Bank Account Closure Letter

| Advantages | Disadvantages |

|---|---|

| Provides a clear and documented record | Can be slightly more time-consuming than online closure (if available) |

| Minimizes the risk of misunderstandings | Requires physical delivery or mailing |

| Ensures a smooth and efficient closure process | May not be accepted by all banks (some may require specific forms) |

Best practices include keeping a copy of your closure letter, confirming the account closure with the bank, and updating any linked automatic payments or direct deposits.

Frequently Asked Questions:

1. What should I include in my account closure letter? (Account number, closure date, forwarding address)

2. Can I close my account online? (Depends on the bank)

3. What happens to any remaining funds in my account? (Transferred or issued as a check)

4. How long does it take to close an account? (Typically a few business days)

5. What happens to any outstanding checks? (May be returned unpaid)

6. Can I reopen a closed account? (Policies vary by bank)

7. What if I lose my account closure letter copy? (Contact the bank for confirmation)

8. What if I have automatic payments linked to the account? (Update them before closing the account)

Tips and tricks: Always double-check your account balance before closing and ensure all outstanding transactions are cleared.

In conclusion, the bank account closure letter, while seemingly a relic of the past, remains a crucial tool in today's financial landscape. It provides clarity, security, and peace of mind during the account closure process. Understanding its importance and following the best practices outlined above can ensure a smooth transition and protect your financial interests. Taking the time to craft a proper closure letter is a small investment that can prevent significant headaches down the road. By proactively managing your financial relationships, you empower yourself to take control of your financial well-being. Don't underestimate the power of a simple letter – it's a small step that can make a big difference in your financial life. So, before you sever ties with your bank, remember the power of the bank account closure letter and ensure a clean and efficient break.

Unlocking your medicare part b benefits

Unraveling the big tree evolution begins chapter 131

Exploring the tranquil hues of sedate gray sw 6169